news & resources for you

Connecting with our communities.

Recent

Florence Bank Promotes Eight Officers

Florence Bank and its Employees Donate $73,520 to the United Way of the Franklin and Hampshire Region

Community Support Award to Team Member Alissa Fuller of Ware

Read MoreAbout Cut These Costs When Facing Financial Hardships

Florence Bank Presents its 2025 President’s Award to Three Employees

Florence Bank Sponsors the 35th Annual Springfield Puerto Rican Parade

Florence Bank Launches Welcome Home First-Time Homebuyer Program

Florence Bank Awards $150,000 to 40 Local Nonprofits at its 23rd Annual Customers’ Choice Community Grants Event

About Chesterfield Community Food CupboarFlorence Bank Promotes Amanda Constantilos of Belchertown to Manager of King Street Branch in Northampton

Florence Bank Hires Commercial Loan Officer and Branch Manager

Florence Bank is pleased to announce it has hired a commercial loan officer and a branch manager.

Xiaolei Hua, of South Hadley, has joined the bank as vice president / commercial loan officer, while Shadia Coley, of Enfield, Connecticut, has been named branch manager / branch officer of the bank’s new Holyoke office set to open in 2026.

.png)

Teach Children to Save

Florence Bank Promotes Ryan Hess to Senior Vice President / Chief Commercial Banking Officer

Florence Bank is pleased to announce that vice president / commercial team leader Ryan Hess of East Longmeadow has been promoted to lead the bank’s commercial lending efforts as senior vice president / chief commercial banking officer.

Florence Bank Donates $40,000 to Valley Community Development Corporation

Florence Bank recently contributed $40,000 to the Northampton-based Valley Community Development Corporation (Valley CDC), a non-profit corporation formed in 1988 to address the shortage of affordable housing and the needs of the community through economic and housing development.

Community

Proud to Pledge $75,000 to Cooley Dickinson Hospital’s $26 million Transforming Emergency Care Campaign

Florence Bank Awards $150,000 to 40 Local Nonprofits at its 23rd Annual Customers’ Choice Community Grants Event

Florence Bank Donates $5,000 to Tech Foundry in its 10th Anniversary Year

Florence Bank Donates $40,000 to Valley Community Development Corporation

Florence Bank recently contributed $40,000 to the Northampton-based Valley Community Development Corporation (Valley CDC), a non-profit corporation formed in 1988 to address the shortage of affordable housing and the needs of the community through economic and housing development.

We Awarded $150,000 to Local Nonprofits at Our 22nd Annual Customers’ Choice Community Grants Event

Florence Bank Supports the Mental Health Association’s 26th Annual Wellness Classic Golf Tournament

About This ArgfhjghjgFlorence Bank Supports Caring Health Center’s Capital Campaign with $100,000 Contribution

Florence Bank Sponsors the 35th Annual Springfield Puerto Rican Parade

Florence Bank Donates $100,000 to the Iron Horse Music Hall

Florence Bank and its Employees Donate $73,520 to the United Way of the Franklin and Hampshire Region

Florence Bank Supports Mass Humanities with a $10,000 Gift

Florence Bank Supports Revitalize CDC’s 2025 #GreenNFit Neighborhood Rebuild Event

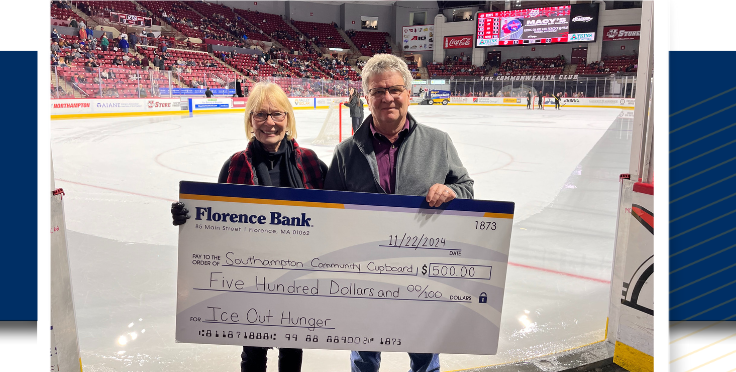

Florence Bank Helps Ice Out Hunger in the Valley for the Second Year

Business

From The Ground Up: Familiars Coffee and Tea

Danny McColgan knew tea. His business and life partner, Isaac Weiner, had experience as a barista. Together, they had the passion, knowledge, experience, and good taste to run their own coffeehouse.

From The Ground Up: Salmon Studios

Sam Ostroff founded Salmon Studios and is both a leader and a laborer there, but he’ll tell you his most critical role in the organization is serving as head of crisis management. That’s because everything the Florence metalwork company creates has never been made before—by anyone—and often, the ingenuity creates quandaries.

One Home for Small Business Success

When Cal and Anne Potter turned on the pumps at their first gas station more than 50 years ago, they couldn’t have imagined how much of an impact that small business would make on the local community.

From The Ground Up: Camp Howe

At the end of every one- or two-week session at Camp Howe, there are always a handful of young people who head home with something they’ve never had before: A recognition award.

From The Ground Up: Crimson & Clover

At Crimson & Clover farm, co-owner Nate Frigard is focused as much on growing relationships with customers as he is on growing lettuce, strawberries, and herbs.

Allergy and Immunology Associates

Florence Bank gave Dr. Jonathan Bayuk and his physician partners a shot at success in 2014, and they turned it into a thriving allergy and immunology practice in Western Massachusetts.

From The Ground Up: Florence Dental

George Falk founded Florence Dental Care in 1974 in a historic home right on Main Street in Florence. His son, Benjamin, was four years old. Ben’s jobs included vacuuming the carpets and sweeping the parking lot in front of the building.

From The Ground Up: Local Burger

Jeff Igneri of Florence knows it’s important to keep up with the trends in the restaurant industry. That’s how he’s made Local Burger of Northampton, Massachusetts, a local success.

Personal

Hit the ground running for the New Year: Three goals for your finances

As the new year sneaks up, it’s a good time to reflect on your financial goals for next year.

Gifts to Spark Excitement and Build Financial Responsibility

The financial habits and money management skills kids learn can follow them for the rest of their lives. If you want to get your kids, grandkids, nieces, and nephews off to a great start, giving financially-themed gifts is always a good idea.

Supporting Charities During the Holiday Season

For some people, the holidays can be a tricky time. Motivated by the seasonal spirit, you want to support your favorite charity, but lack the funds to make a meaningful impact. However, while monetary donations are always appreciated, many organizations need more than cash to make a difference.

Three Facts on Personal Finance

Do you feel financially secure? If the answer is no, you’re not alone! Here are three facts that people get wrong most often when it comes to finances.

Effective Money Tips For Parents To-be

Teens and Money: Checking and Savings Accounts

One of the first steps toward real freedom (and adulthood) is having a checking and savings account in your own name. These accounts allow you to save money, make purchases, and pay bills efficiently.

Food Shopping: The Blind Spot in Our Spending Plan

While meals are of course a necessity, take a look at your food-buying habits. Odds are that there’s room to save.

College Planning 101

Most parents have already heard the bad news: a college education has never been more expensive. The good news is that there’s a lot parents can do to help their children and make the costs of college more manageable.

Earn Cash and Rebates with Florence Bank Cashback Checking

Stop Wasting Money on These Things Now

It’s possible you’re spending money on things you don’t really need. Save yourself some money by giving them up and redirecting those dollars toward your savings, retirement, or investment accounts.

Is it time to open a checking or savings account for our children?

If you want to equip your kids with the tools to be financially secure adults, a good place to start is with a savings and/or checking account.

Understanding Different Types of Student Loans

If you or a family member will be attending college soon, you’ve probably noticed that the sticker price for a college education has risen considerably in recent years. Though the costs can be steep, a college degree is a good investment in the student’s future.

Creative Ways to Lower Holiday Spending

A little bit of creativity and energy can get you through the holidays without draining your wallet.

News

Florence Bank Promotes Ryan Hess to Senior Vice President / Chief Commercial Banking Officer

Florence Bank is pleased to announce that vice president / commercial team leader Ryan Hess of East Longmeadow has been promoted to lead the bank’s commercial lending efforts as senior vice president / chief commercial banking officer.

Florence Bank Promotes Eight Officers

Community Support Award to Team Member Alissa Fuller of Ware

About Chesterfield Community Food CupboarFlorence Bank Promotes Amanda Constantilos of Belchertown to Manager of King Street Branch in Northampton

Florence Bank Hires Meghan Parnell as Vice President / Credit Manager

Florence Bank Presents its 2025 President’s Award to Three Employees

Florence Bank Hires Commercial Loan Officer and Branch Manager

Florence Bank is pleased to announce it has hired a commercial loan officer and a branch manager.

Xiaolei Hua, of South Hadley, has joined the bank as vice president / commercial loan officer, while Shadia Coley, of Enfield, Connecticut, has been named branch manager / branch officer of the bank’s new Holyoke office set to open in 2026.

Florence Bank Welcomes Andrew Sullivan of Wilbraham as Vice President / Commercial Lender

Florence Bank is pleased to welcome Andrew Sullivan of Wilbraham to our staff as vice president / commercial lender.

Three Employees Lauded with the 2024 President’s Award

Our 2024 Community Support Award Goes to Team Member Kim Baker of Hatfield

Fraud Awareness

What To Do If You Think You've Fallen Victim to Fraud

If you are a Florence Bank customer and suspect your account with us has been comprised by online crime, please—even if you have only the slightest suspicion—make your first call to our customer service team.

Getting Ahead of Fraud

Fraud keeps finding unsuspecting victims. At least three to five times a day, we get calls from customers who have been tricked into giving out their private account information, and money has been stolen from them—sometimes thousands of dollars.

Financial Education

Don’t Miss Out on the Home of Your Dreams—Lock, Before You Shop

Five Easy Ways To Cut Monthly Expenses

Ever notice how your monthly expenses always seem to equal whatever salary you’re making, even after you get raises? The phenomenon is called “lifestyle creep” and it can keep you from reaching financial goals.

Five Ways Millennials Can Build A Brighter Financial Future

Financial Tips For The Sandwich Generation

If you find yourself squeezed between caring for your children and caring for your aging parents, you’re part of what’s now referred to as the Sandwich Generation.

Reducing Seasonal Energy Costs

For many of us, winter means high energy bills, but sitting in the dark or turning off the heat are not your only options. Here are some ways to improve your home’s energy efficiency and save money during the cold months.

Five Ways To Redefine Yourself As A Saver

Restricting spending to the finite boundary of a paycheck is the foundation of sound money management, actually doing it can be extremely difficult.

.png)

Teach Children to Save

How To Manage Finances Through The Years

There are certain times in life when particular money management areas need special focus. Whatever your situation, it’s important to plan ahead to accommodate the coming changes in your financial situation.

National Financial Literacy Month

April is recognized as National Financial Literacy Month, dedicated to raising awareness about the importance of financial education and empowering individuals with the knowledge and tools to assess, improve, and take control of their financial futures.

Money Missteps - A Great Thing To Happen To A Kid?

While the outrage at a teenager spending an entire pile of birthday money on one pair of jeans is understandable, you might want to look at it as a good thing. Sound crazy?

A Step-By-Step Guide To Making A Holiday Budget

If you recently looked at the calendar and realized gift-buying season is closer than you thought, don’t worry. We are here to help you organize your finances by making an effective budget.

Five Big Mistakes Even Smart People Make With Credit Cards

Despite the popularity of credit card accounts, it’s easy for holders to make mistakes that can cost them money. These are the top blunders to avoid.

Did you know that in the process of maintaining your property and paying your mortgage each month, you’ve accumulated valuable equity in your home? And that you can borrow money using that equity as collateral?

News articles you need to meet your financial goals. (h2)

Reducing Seasonal Energy Costs

Reducing Seasonal Energy Costs

Reducing Seasonal Energy Costs

Reducing Seasonal Energy Costs

Reducing Seasonal Energy Costs

Reducing Seasonal Energy Costs

Financial education

Information you need to meet your financial goals.

We're not just here for your banking needs, we're also here to help you learn everything you can about your financial needs. Whether it's our personal finance center, or our educational programs designed to maximize retirement, we're always thinking about how to make your financial life just as happy as the rest of your life.