Florence Bank

Monitoring your accounts 24/7.

At Florence Bank we use a combination of security features to help protect your accounts against fraud. FraudDetect, our fraud monitoring system, is a powerful tool that works 24/7 to detect suspicious activity on your debit card. When suspicious activity is detected, one of our trained specialists will contact you to confirm or deny the recent transactions and take necessary action if needed.

Potential fraudulent activity includes:

- A sudden change in location

- A rapid string of expensive purchases

- Any new transaction patterns associated with fraud trends around the world

Based on the contact information we have for you on file, you will be contacted by our fraud specialists in this order:

Your Response Is Important.

Responding to our fraud notifications is critical to prevent potential risk and avoid restrictions that may be placed on your card. If fraudulent activity is suspected on your debit card, one of our trained specialists will contact you and ask you via email, text or phone to confirm or deny the transaction.

Please ensure that we have your up to date contact information on file so we can notify you if there is suspicious activity on your account.

| If you received: | Please call: |

| An Email | 833.735.1891 |

| A Text Message | 833.735.1897 |

| A Phone Call | 833.735.1891 |

Suspect Fraud? Lost or Stolen Debit Card?

To report fraudulent activity:

| FraudDetect | |

|---|---|

| During Business Hours | 413.586.1300 |

| After Hours | 833.735.1891 |

| International | 614.564.5105 |

To report a lost or stolen debit card:

| Card Services | |

|---|---|

| During Business Hours | 413.586.1300 |

| After Hours | 833.337.6075 |

| International | 614.564.5105 |

FraudDetect FAQs

What is FraudDetect?

FraudDetect, our fraud monitoring system, is a powerful tool that works 24/7 to detect suspicious activity on your debit card. When suspicious activity is detected, one of our trained specialists will contact you to confirm or deny the recent transactions and take necessary action if needed.

What will happen during the notification?

Based on the information we have for you on file, you will be contacted by our fraud specialists in this order:

Email

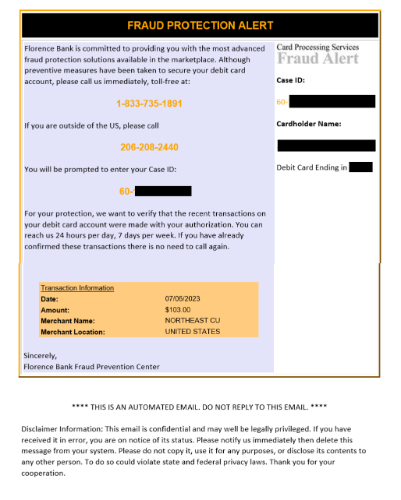

An email will be sent to the email address we have for you on file. The email will include details regarding the suspicious transaction on your account and will provide instructions on what to do next. Be sure to have your case number ready when contacting FraudDetect. Below is an example of a FraudDetect email:

Text

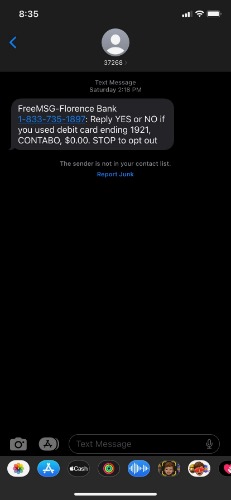

After an email is delivered, a text message will be sent from “37268.” The text message will include details regarding the suspicious transaction and will ask you to verify or deny the transaction. Below is an example of a FraudDetect text message:

Phone

If there is no response to the text, you will receive a phone call from FraudDetect and they will inform you that they are calling on behalf of Florence Bank. They will ask you to verify your identity and to verify a recent transaction on your card (for example, "Did you recently make a purchase in the amount of $14.92 at ABC gas station?")

What if I miss the call?

If you miss their call, FraudDetect will leave a voicemail that will include a case number and a phone number to call back. Be sure to have your case number ready when contacting FraudDetect. If you have any questions, please contact us at 413.586.1300 during business hours.

What if you don't have my phone number or email address?

Please ensure that we have your up to date contact information on file so we can notify you if there is suspicious activity on your account. You can verify your information by calling us at 413.586.1300, logging in to Online Banking, or stopping by your nearest branch.

What kind of activity might trigger outreach from FraudDetect?

FraudDetect predicts the probability of fraud by comparing transactions to current fraud trends and will notify the customer if something seems suspicious. Potentially fraudulent activity includes a sudden change in location, a sudden string of expensive purchases, or any new transaction patterns associated with fraud trends around the world.

Please remember to notify us before you travel so that we can help you plan for any hiccups that might occur along the way. Also, be aware that there are certain locations within the U.S. where your debit card might be blocked. This is why it is essential to always have a backup form of payment.

What happens if my card information has been compromised?

In the event that fraud has taken place on your account, please contact us during business hours at 413.586.1300 or stop by your local branch to receive a new debit card and review debit card transactions. A dispute will be filed on your behalf if fraudulent transactions cleared your account.