Have you ever applied for a mortgage with us or another mortgage lender and noticed that shortly after submitting your application, you began receiving phone calls, letters, and emails with offers from other mortgage lenders?

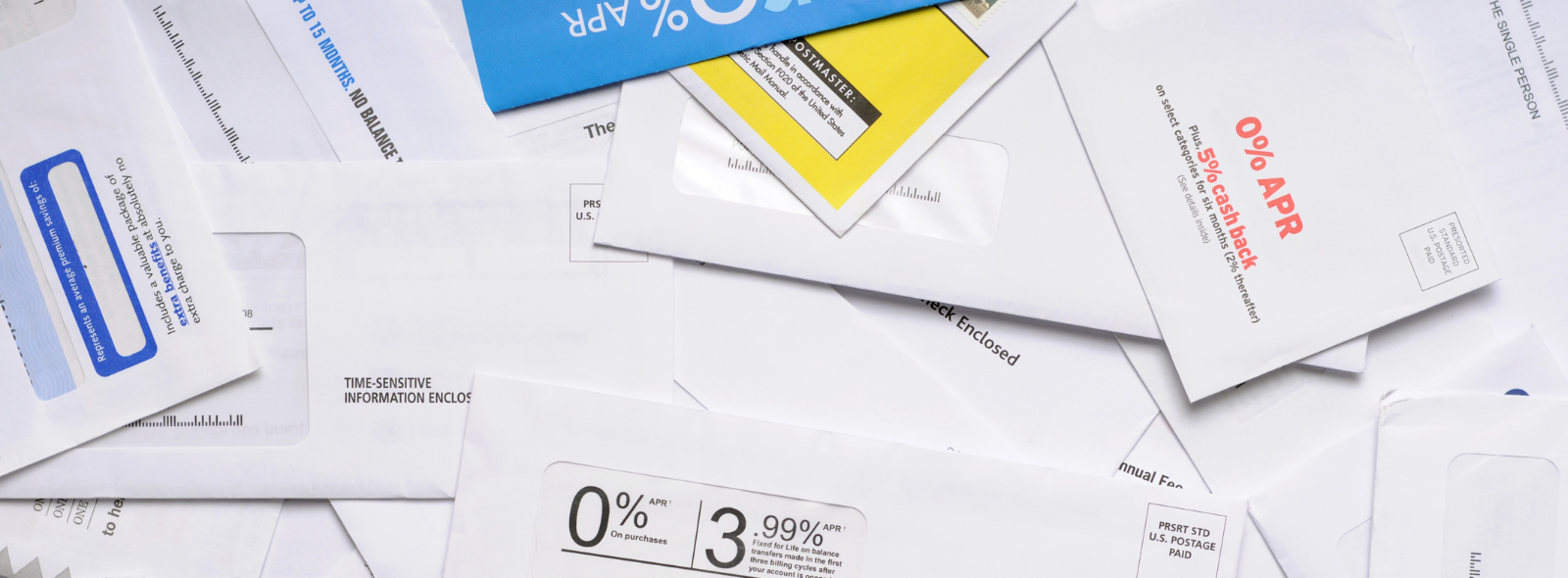

The offers you've been receiving are known as "trigger leads" and typically occur following a hard inquiry on your credit report.

What are trigger leads?

When you apply for a mortgage at a bank, credit union, or mortgage company, a request is made to the three major credit bureaus to access and review your credit report, which is known as a “hard inquiry.” When a hard inquiry occurs, that request becomes a "lead" for companies who have a direct marketing agreement with the credit bureaus. Those "leads" are then used to contact you using the information on file with the credit bureaus.

While trigger leads can be confusing and annoying, they are legal under the Fair Credit Reporting Act (FCRA) since they technically provide consumers with an opportunity to compare mortgage rates and costs. Unfortunately, given how this process currently works, the potential for fraud is always a concern.

Does Florence Bank participate in this program or sell customer information?

We DO NOT participate in the trigger leads program and we DO NOT sell customer information to third-party companies.

Is there a way to avoid trigger leads?

Yes. You can opt-out from receiving pre-screened offers as follows:

- Online: https://www.optoutprescreen.com/

- Phone: 1-888-5-OPT-OUT (1-888-567-8688)

In addition, you can add your phone number to the National Do Not Call Registry.

- Online: https://www.donotcall.gov/

- Phone: 1-888-382-1222

Please note that it can take up to five business days to opt out, so if a hard inquiry has already occurred, it may not block immediate offers.

Please feel free to contact us at 413.586.1300 if we can be of further assistance. We want your mortgage experience with us to be easy, convenient, and hassle-free—from application to closing. Always.